Small business inventory donation offers a unique opportunity for businesses to make a meaningful impact while reaping tangible benefits. This comprehensive guide delves into the types of eligible donations, financial incentives, and the process of finding organizations to accept these contributions.

By following best practices and maximizing the effectiveness of inventory donation programs, small businesses can enhance their reputation, strengthen community ties, and support organizations in need.

Types of Small Business Inventory Donations

Small businesses can donate a wide range of inventory items to qualified charitable organizations, including:

- New or gently used products

- Excess or discontinued stock

- Damaged or defective items (subject to restrictions)

- Raw materials and supplies

- Equipment and machinery

- Gift cards and certificates

Eligible donations must meet certain criteria, such as being in good condition and having value to the recipient organization. Some restrictions may apply, such as prohibitions on donating perishable goods or hazardous materials.

Tax Deductions for Inventory Donations

Small businesses may be eligible for tax deductions for inventory donations. The amount of the deduction depends on the fair market value of the donated items and the business’s tax bracket.

Benefits of Inventory Donations for Small Businesses

Inventory donations offer significant advantages to small businesses, both financially and reputationally. This guide explores the benefits associated with inventory donations and provides real-world examples of businesses that have reaped the rewards.

Tax Deductions and Financial Incentives

One of the primary benefits of inventory donations is the potential for tax deductions. Businesses can deduct the fair market value of donated inventory from their taxable income, reducing their overall tax liability. This can lead to substantial savings, especially for businesses with large inventories or excess stock.

In addition to tax deductions, some organizations may offer matching grants or other financial incentives to businesses that donate inventory. These incentives can further enhance the financial benefits of inventory donations.

Case Studies of Successful Inventory Donations

Numerous small businesses have successfully utilized inventory donations to their advantage. Here are a few notable examples:

- Clothing Boutique:A small clothing boutique donated excess inventory to a local homeless shelter. The donation not only provided much-needed clothing to those in need but also resulted in a significant tax deduction for the boutique.

- Grocery Store:A local grocery store donated perishable goods that were nearing their expiration date to a food bank. The donation helped reduce waste and provided nutritious meals to those facing food insecurity.

- Office Supply Company:An office supply company donated surplus office supplies to a local school, providing essential materials for students and teachers.

Reputation Enhancement and Community Involvement

Inventory donations can also enhance a business’s reputation and foster community involvement. By supporting charitable organizations and causes, businesses demonstrate their commitment to social responsibility and community well-being.

Positive media coverage and customer appreciation can further enhance a business’s reputation. Additionally, inventory donations can provide opportunities for employee engagement and team-building activities.

Finding Organizations to Accept Inventory Donations

Identifying reputable organizations that align with your business’s values and accept inventory donations is crucial. Explore the following resources to locate potential recipients:

- Local charities and non-profit organizations:Reach out to organizations in your community that support causes related to your business or products.

- National organizations:Consider organizations such as Goodwill, Salvation Army, or Habitat for Humanity that accept inventory donations nationwide.

- Online platforms:Websites like DonationMatch.com and JustGive.org connect businesses with organizations seeking inventory donations.

Contacting Potential Donation Recipients

Once you have identified potential recipients, reach out to them directly to inquire about their donation acceptance policies. Provide clear information about the inventory you have available, its condition, and any specific requirements you may have.

Matching Donations to Organizational Needs

It’s essential to match your inventory donations to the organization’s mission and specific needs. Research the organization’s website or contact them directly to understand their priorities. This ensures that your donation will have the greatest impact and support their cause effectively.

Preparing and Shipping Inventory Donations

To ensure your inventory donations reach their intended recipients safely and efficiently, it’s crucial to prepare and ship them properly. Here’s a step-by-step guide to help you through the process.

Packaging

Choose sturdy boxes or containers that can withstand handling and transportation. Ensure the boxes are the appropriate size for the items being donated and fill them to capacity to prevent shifting during transit.

- Use bubble wrap, packing peanuts, or other cushioning materials to protect fragile items from damage.

- Seal boxes securely with strong tape to prevent them from opening during shipping.

Labeling

Clearly label each box with the following information:

- Name and address of the recipient organization

- Contents of the box

- Your contact information

Documentation

Include a packing slip or inventory list inside each box, detailing the items and their condition. This will help the recipient verify the donation and ensure they receive what was intended.

Shipping

Arrange for shipping through a reliable carrier that offers tracking services. Choose a shipping method that balances cost and delivery time based on the size and value of the donation.

- Get quotes from multiple carriers to compare prices and services.

- Insure the shipment to protect against loss or damage during transit.

Tracking and Reporting Inventory Donations: Small Business Inventory Donation

Accurate tracking and reporting of inventory donations are crucial for small businesses to ensure compliance with tax regulations and maintain accountability. Maintaining detailed records allows businesses to substantiate their donations for tax deductions and demonstrate responsible stewardship of donated goods.

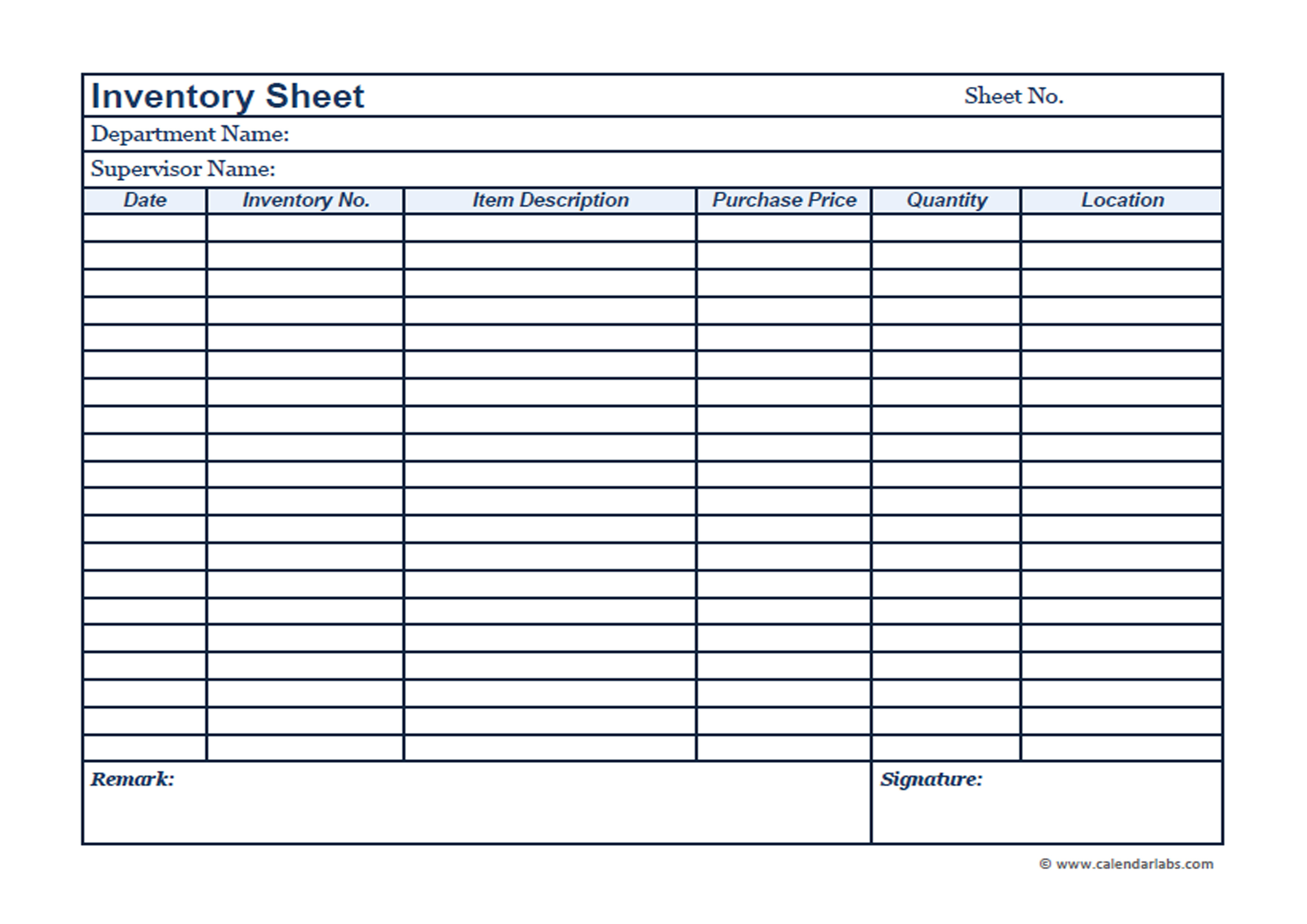

Donation Log or Tracking System

Establish a comprehensive donation log or tracking system to record all inventory donations, including the following information:

- Date of donation

- Description of donated items

- Quantity and unit cost of items

- Name and contact information of the recipient organization

- Method of donation (e.g., in-kind, cash equivalent)

- Fair market value (FMV) of donated items

IRS Reporting Requirements

Small businesses are required to report inventory donations to the IRS on their tax returns. The following rules apply:

- Donations over $5,000 require a written acknowledgement from the recipient organization.

- Donations of non-cash property (e.g., inventory) require a qualified appraisal if the FMV exceeds $5,000.

- Businesses must maintain adequate records to support the claimed deductions.

Failure to comply with these reporting requirements can result in penalties or disallowed deductions.

Other Relevant Authorities, Small business inventory donation

In addition to the IRS, businesses may need to report inventory donations to other relevant authorities, such as state tax agencies or local governments. It is important to check with local regulations to determine specific reporting requirements.

Best Practices for Small Business Inventory Donations

Maximize the impact of your inventory donations by following these best practices, ensuring ethical considerations and transparency in your donation practices.

To evaluate the effectiveness of your inventory donation programs, consider tracking metrics such as the quantity and value of donated items, the number of organizations supported, and the impact on your business’s sustainability goals.

Transparency and Ethical Considerations

Maintain transparency by clearly communicating your donation policies to both internal and external stakeholders. Ensure that all donations are made in compliance with applicable laws and regulations.

Evaluating Effectiveness

To assess the effectiveness of your inventory donation program, consider the following metrics:

- Quantity and value of donated items

- Number of organizations supported

- Impact on your business’s sustainability goals

Last Point

In conclusion, small business inventory donation is a valuable tool for businesses looking to give back to their communities and optimize their operations. By understanding the benefits, identifying reputable organizations, and implementing effective donation practices, small businesses can create a positive impact while enhancing their own brand and reputation.

Essential Questionnaire

What types of inventory items are eligible for donation?

Eligible inventory items include new or gently used products, raw materials, and supplies that are still in good condition and have value.

How can inventory donations benefit small businesses financially?

Inventory donations can lead to tax deductions, reducing the taxable income of the business and potentially lowering tax liability.

What is the importance of matching donations to an organization’s mission?

Matching donations to an organization’s mission ensures that the donated items will be used for their intended purpose and will have the greatest impact.