Business inventory exemption texas – The business inventory exemption in Texas offers significant benefits to businesses by exempting eligible inventory from property taxes. This exemption can lead to substantial savings and improved cash flow for businesses that maintain inventory as part of their operations. In this comprehensive guide, we will delve into the intricacies of the business inventory exemption in Texas, exploring its purpose, eligibility requirements, application process, and best practices for inventory management.

Understanding the nuances of the business inventory exemption is crucial for businesses seeking to optimize their inventory management and maximize their tax savings. By leveraging this exemption effectively, businesses can enhance their financial performance and gain a competitive edge in the marketplace.

Texas Business Inventory Exemption Overview

The Texas Business Inventory Exemption is a valuable tax break that can save businesses money on their property taxes. This exemption applies to the value of inventory held for sale in the ordinary course of business.

To qualify for the exemption, businesses must meet certain requirements. First, the business must be engaged in the sale of tangible personal property. Second, the inventory must be held for sale in the ordinary course of business. This means that the inventory must be intended for sale to customers and not for use in the production of other goods or services.

Eligible Businesses

A wide variety of businesses can qualify for the business inventory exemption. Some common examples include:

- Retail stores

- Wholesalers

- Manufacturers

- Distributors

Types of Inventory Covered, Business inventory exemption texas

The business inventory exemption covers a wide variety of types of inventory. Some common examples include:

- Raw materials

- Work-in-process

- Finished goods

- Supplies

Eligibility Requirements

Businesses in Texas can qualify for the Business Inventory Exemption if they meet specific criteria and maintain proper documentation for verification.

To be eligible, businesses must:

Physical Presence

- Have a physical presence in Texas, such as a warehouse, distribution center, or retail store.

- Store the inventory within the state of Texas.

Ownership

- Own the inventory or have a legal right to possess it, such as through a lease or consignment agreement.

- Not be holding the inventory for another person or entity.

Inventory Classification

- The inventory must be classified as tangible personal property used in the business’s operations.

- Examples include raw materials, work-in-progress, and finished goods.

Documentation and Records

Businesses must maintain proper documentation and records to verify their eligibility for the exemption, including:

- Inventory records detailing the quantity, description, and value of the inventory.

- Proof of ownership or legal possession, such as purchase orders, invoices, or consignment agreements.

- Records showing the physical location of the inventory within Texas.

Excluded Property

The Texas Business Inventory Exemption does not apply to all types of inventory. Certain categories of property are specifically excluded from the exemption.

The reasons for these exclusions vary depending on the type of property, but generally speaking, they are intended to ensure that the exemption is not abused and that it is used for its intended purpose, which is to support businesses in Texas.

Raw Materials

Raw materials are not eligible for the business inventory exemption. Raw materials are defined as materials that have not yet been incorporated into a finished product. The exclusion of raw materials from the exemption is intended to prevent businesses from stockpiling raw materials in order to avoid paying property taxes.

Work in Progress

Work in progress is also not eligible for the business inventory exemption. Work in progress is defined as partially completed products that are still in the process of being manufactured. The exclusion of work in progress from the exemption is intended to prevent businesses from claiming the exemption on products that are not yet ready for sale.

Finished Goods

Finished goods are not eligible for the business inventory exemption if they are held for more than 12 months. This exclusion is intended to prevent businesses from using the exemption to avoid paying property taxes on finished goods that are not being actively sold.

Property Held for Sale

Property that is held for sale is not eligible for the business inventory exemption. Property held for sale is defined as property that is not intended to be used in the business’s operations and is instead held for the purpose of being sold.

The exclusion of property held for sale from the exemption is intended to prevent businesses from using the exemption to avoid paying property taxes on property that is not used in their business.

Application Process

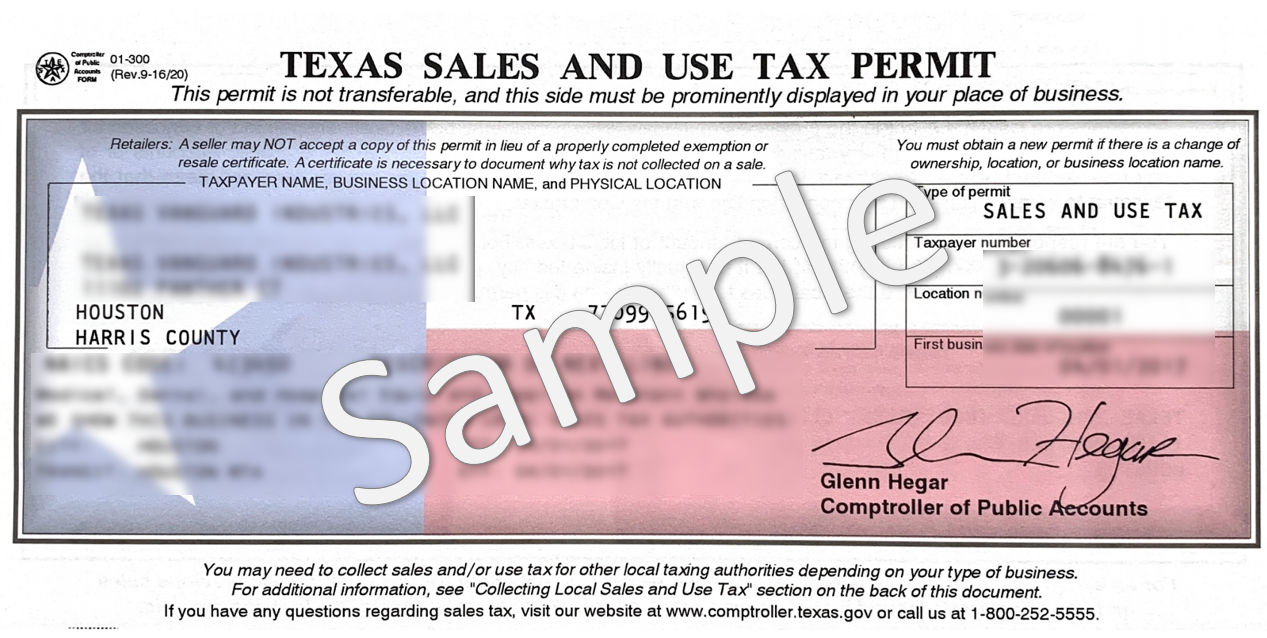

Obtaining a business inventory exemption in Texas involves a straightforward application process. The Texas Comptroller of Public Accounts (CPA) oversees the exemption and provides detailed guidelines for applicants.

The application process typically includes the following steps:

Deadlines

The deadline for filing an application for a business inventory exemption is April 15of the year following the year in which the inventory was acquired.

Forms

To apply, businesses must complete and submit Form 50-155, Application for Business Inventory Exemption. The form is available on the CPA’s website.

Required Documentation

Along with the completed application, businesses must provide supporting documentation, such as:

- A copy of the business’s certificate of organization or assumed name certificate

- A detailed inventory list, including the quantity, description, and cost of each item

- Proof of ownership of the inventory, such as invoices or purchase orders

Once the application and supporting documentation are submitted, the CPA will review the information and determine the eligibility of the business for the exemption.

Compliance and Enforcement

Maintaining compliance with the Texas Business Inventory Exemption is crucial for businesses to avoid potential penalties. Businesses are responsible for:

- Accurate and timely filing of exemption applications

- Maintaining proper documentation to support their exemption claims

- Responding to audit requests and providing necessary information

Non-compliance can result in:

- Denial or revocation of the exemption

- Assessment of back taxes and penalties

Audit Procedures

The Texas Comptroller’s Office conducts audits to ensure compliance with the exemption. During an audit, businesses may be required to provide documentation such as:

- Inventory records

- Purchase orders

- Sales invoices

- Leases or rental agreements

Businesses should cooperate fully with audit requests and provide accurate information to maintain their exemption status.

Case Studies and Examples

The business inventory exemption has been successfully utilized by various businesses in Texas. Let’s explore a few case studies and examples to understand their strategies, challenges, and outcomes.

Example 1: Manufacturing Company

A manufacturing company in Dallas utilized the business inventory exemption to reduce its property tax liability. The company had a large inventory of raw materials, finished goods, and work-in-progress. By qualifying for the exemption, the company saved a significant amount on its annual property tax bill.

Example 2: Retail Store

A retail store in Houston used the business inventory exemption to lower its property taxes. The store had a large inventory of clothing, electronics, and home goods. The exemption allowed the store to reduce its tax liability and pass on the savings to its customers.

Example 3: Wholesaler

A wholesaler in Austin successfully claimed the business inventory exemption. The wholesaler had a large inventory of food and beverage products. The exemption helped the wholesaler reduce its operating costs and remain competitive in the market.

Industry-Specific Considerations: Business Inventory Exemption Texas

The business inventory exemption in Texas may present unique considerations and challenges for specific industries. Understanding these nuances is crucial for ensuring compliance and maximizing the benefits of the exemption.

This section explores industry-specific considerations and provides tailored guidance to assist businesses in navigating the complexities of the exemption.

Manufacturing

Manufacturers typically maintain a substantial inventory of raw materials, work-in-progress, and finished goods. It is essential to distinguish between exempt and non-exempt inventory items. For example, raw materials used in the production process qualify for the exemption, while finished goods intended for sale are generally not exempt.

Retail

Retailers face challenges in determining the taxability of inventory held for resale. The exemption applies to inventory held at the retail establishment, but not to inventory stored at a warehouse or distribution center. Additionally, retailers must consider the impact of sales tax holidays and promotional discounts on the exemption.

Technology

Technology companies often deal with intangible property, such as software and intellectual property. While these assets may not be considered traditional inventory, they may qualify for the exemption if they are held for resale or lease.

Future Trends and Outlook

The business inventory exemption is constantly evolving, influenced by technological advancements and changes in the business landscape. Understanding these trends is crucial for businesses to optimize their inventory management and stay compliant.

One significant trend is the rise of e-commerce and omnichannel retailing. As more businesses adopt online sales, the demand for efficient inventory management systems has increased. Cloud-based inventory management software and real-time inventory tracking technologies are becoming increasingly popular, allowing businesses to monitor their inventory levels across multiple channels and locations.

Technological Advancements

- Cloud-based inventory management systems enable businesses to access their inventory data from anywhere with an internet connection, providing real-time visibility and control.

- Radio frequency identification (RFID) and barcode scanning technologies enhance inventory accuracy and reduce the time spent on manual counting.

- Artificial intelligence (AI) and machine learning algorithms can analyze inventory data to predict demand, optimize stock levels, and identify potential issues.

These technological advancements are streamlining inventory management processes, reducing costs, and improving efficiency.

Ultimate Conclusion

In conclusion, the business inventory exemption in Texas is a valuable tool for businesses to reduce their property tax burden and improve their financial health. By meeting the eligibility requirements, maintaining compliance, and implementing sound inventory management practices, businesses can fully capitalize on the benefits of this exemption.

The information provided in this guide serves as a roadmap for businesses to navigate the complexities of the exemption and unlock its full potential.

User Queries

Who is eligible for the business inventory exemption in Texas?

Businesses that maintain inventory as part of their normal business operations are generally eligible for the exemption. This includes manufacturers, wholesalers, retailers, and certain service providers.

What types of inventory are eligible for the exemption?

Eligible inventory includes raw materials, work-in-progress, and finished goods that are held for sale or use in the ordinary course of business.

What is the application process for the business inventory exemption?

Businesses must file an application with the local appraisal district by May 15th of each year. The application requires detailed information about the inventory, including its location, value, and ownership.

What are the penalties for non-compliance with the business inventory exemption?

Businesses that fail to comply with the exemption requirements may be subject to property taxes on their inventory. Additionally, they may face penalties and interest charges.