Business inventories gross private domestic investment – Step into the intriguing world of business inventories and gross private domestic investment, where the fate of economies hangs in the balance. Let’s dive into this dance of supply and demand, where every inventory twist affects the GPDI tango.

From bulging warehouses to calculated investments, we’ll explore how businesses waltz with their stockpiles, and how those gyrations ripple through the economic landscape.

Business Inventories

Business inventories refer to the stock of goods held by businesses at various stages of production, distribution, and sales. These inventories are crucial for ensuring smooth business operations and meeting customer demand.

Types of Business Inventories, Business inventories gross private domestic investment

There are three main types of business inventories:

- Raw materials:These are the basic materials used in the production process, such as steel, wood, or fabric.

- Work-in-process:These are partially completed goods that are still in the production process.

- Finished goods:These are completed products that are ready for sale to customers.

Inventory Management

Businesses use various techniques to manage their inventories effectively. These include:

- Just-in-time inventory:This involves holding only the inventory necessary to meet current demand, minimizing storage costs and waste.

- Economic order quantity:This is the optimal quantity of inventory to order at a time, balancing ordering costs with holding costs.

- Inventory turnover ratio:This measures how efficiently a business is using its inventory, calculated as the cost of goods sold divided by the average inventory value.

Relationship between Business Inventories and GPDI

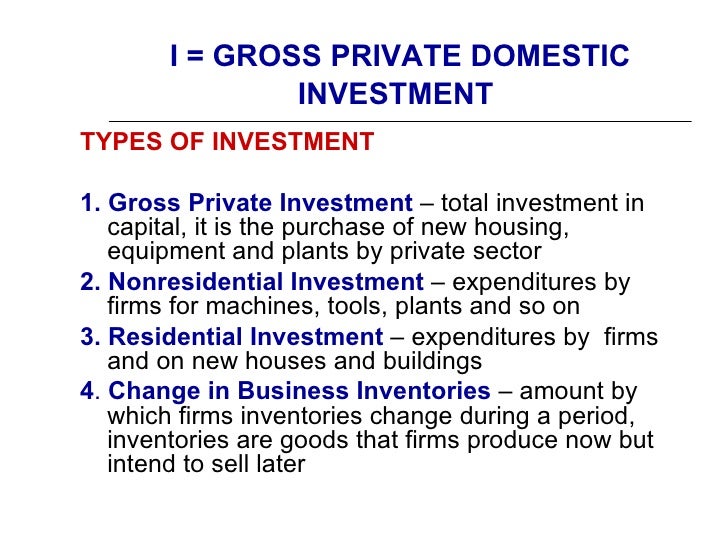

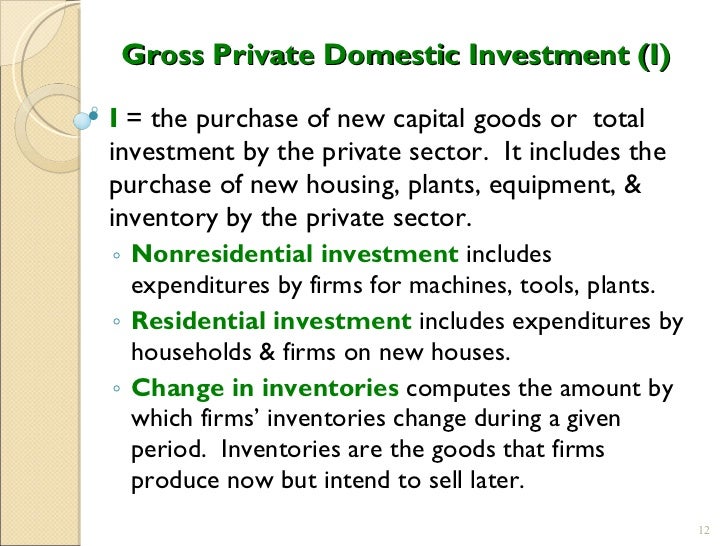

Business inventories and gross private domestic investment (GPDI) are closely intertwined, with changes in one often impacting the other. GPDI, a component of GDP, measures the value of new capital goods and inventories produced domestically. Business inventories, on the other hand, represent the stock of unsold finished goods and materials held by businesses.

Changes in Business Inventories and GPDI

When businesses increase their inventories, it can lead to a rise in GPDI. This is because the value of the additional inventory is included in GPDI calculations. Conversely, when businesses reduce their inventories, it can result in a decrease in GPDI.

Historical Data

Historically, there has been a strong correlation between business inventories and GPDI. For instance, during the Great Recession of 2008-2009, businesses drastically reduced their inventories, contributing to a significant decline in GPDI. Conversely, during periods of economic expansion, businesses tend to increase their inventories, leading to an increase in GPDI.

Forecasting Business Inventories and GPDI

Forecasting business inventories and GPDI is a crucial task for businesses and economists alike. Accurate forecasts help businesses make informed decisions about production, inventory management, and investment. There are several methods for forecasting business inventories and GPDI, each with its own strengths and weaknesses.

Methods for Forecasting Business Inventories

Trend Analysis

This method involves analyzing historical data on business inventories to identify trends and patterns. The forecaster then extrapolates these trends into the future to make predictions.

Econometric Models

These models use statistical techniques to analyze the relationship between business inventories and other economic variables, such as GDP, interest rates, and consumer spending. The model can then be used to forecast business inventories based on changes in these variables.

Judgmental Forecasts

This method involves using the expertise and judgment of experienced professionals to make forecasts. These professionals may consider a variety of factors, including economic data, industry trends, and company-specific information.

Methods for Forecasting GPDI

Gross Domestic Product (GDP) Forecasts

GPDI is a component of GDP, so GDP forecasts can be used to indirectly forecast GPDI. GDP forecasts are typically made by government agencies or economic research firms using a variety of economic models.

Investment Surveys

Businesses are regularly surveyed about their investment plans. These surveys can provide valuable insights into future GPDI trends.

Econometric Models

Similar to business inventory forecasting, econometric models can be used to analyze the relationship between GPDI and other economic variables. These models can then be used to forecast GPDI based on changes in these variables.

Examples of How Forecasts Are Used in Business Decision-Making

Production Planning

Businesses use inventory forecasts to plan production levels. Accurate forecasts help businesses avoid overproduction or underproduction, which can lead to lost profits or missed sales.

Inventory Management

Inventory forecasts help businesses manage their inventory levels. Accurate forecasts help businesses avoid holding too much inventory, which can tie up cash and lead to spoilage or obsolescence.

Investment Decisions

Businesses use GPDI forecasts to make investment decisions. Accurate forecasts help businesses decide when and how much to invest in new equipment, buildings, or other assets.

Closure

So, there you have it, the intricate tango of business inventories and gross private domestic investment. Remember, it’s not just about the stockpiles or the investments, but the rhythm they create that shapes the economic beat.

FAQ Resource: Business Inventories Gross Private Domestic Investment

Q: Why do businesses keep inventories?

A: To meet customer demand, smooth out production, and take advantage of economies of scale.

Q: How does GPDI differ from GDP?

A: GPDI only includes private investment, while GDP includes both private and public investment.

Q: Can changes in business inventories affect economic growth?

A: Yes, a buildup in inventories can slow growth, while a drawdown can boost it.